Do you know how to get to the H&R Block Login page? Before we get started, let’s take a look at H&R Block. It is a well-known American tax preparation firm that operates in Canada.

Table of Contents

A Brief Overview of H&R Block

H&R Block, Inc., also known as H and R Block, is a well-known American tax consulting firm with offices in North America, Australia, and India. Henry W. Bloch and Richard Bloch established the company in 1955. By 2018, H & R Block will have around 12,000 tax offices with tax experts all over the world.

It also provides specialized tax software, as well as online tax preparation and filing via its website. The Kansas City-based firm also offers a strong payroll and business consulting services.

| Official Name | H and R Block |

| Organization | H&R Block |

| Portal Type | Login Portal |

| User | H&R Block Customers |

| Country | USA |

How does H&R Block Work?

H&R Block is well known for its locations around the United States, but the corporation now provides online filing and downloadable computer software. If you select an online package, you can complete your taxes using the mobile app for Android and iOS devices.

H&R Block’s modern and user-friendly interface caters to the vast majority of tax filers. The website, like other tax-preparation services, leads users through a series of questions about their home, income, and potential deductions and credits.

In addition to these questions, you must include information from your employment, other sources of income, and 1099, 1098, W-2, and other tax papers that may arrive in your mailbox or email.

For an extra cost, H&R Block may link you with a professional in its network if you’re worried about making mistakes, missing deductions, or getting lost among the tax forms.

Create Account To Access H&R Block Services

To register your H&R Block login account, follow the instructions below.

- To begin, go to the official H and R Block website at www.hrblock.com.

- A new website will then open on your screen, with the phrase “Create an account” given on the right side of this page. Simply click on this paragraph.

- After pressing this button, enter your full name, a valid email address, and any passwords that may be necessary.

- Click the record button on the right.

- You will be contacted through email. Enter the code you were received.

- This will set up your H&R Block login account online. Your login and password will then be delivered to your cell phone number.

- Log in and answer a few security questions to regain your account easy if you forget your password.

- You have officially joined the H and R Block login account. You can get to it at any time.

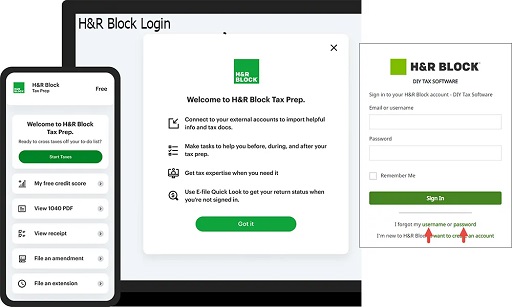

Login to H&R Block – H&R Block Log In

Accessing or logging into an H&R Block online account is simple and free. Keep in mind that if you do not already have an online account, you can register and establish one for free. If you have previously registered on the site, you can access your account at any time using your login credentials.

Have an account already? Know- How to Login

Please see the procedures below for further information on the H and R Block login.

- First, go to the official H and R Block website at www.hrblock.com.

- A web page will display on the screen; look for my account login in the upper right corner of the main page. You can now finish your login directly from this form.

- Carefully input your email address in the first field of the H and R Block registration form, followed by your H and R Block password in the second area of this form.

- Finally, you must complete the H and R Block login registration process by clicking the “Register” button. You can now simply access your account if you input all of the information correctly.

You will be logged in to your H&R Block account if the login credentials you supplied are correct.

H&R Block Username or Password Reset

If you have lost or forgotten your account’s username or password, you can reset it by following the steps below.

Reset your lost password by following the steps below:

- Go to the website hrblock.com.

- Enter the registered phone number, email address, or login and click Next.

- Go to your email box

- Search for recent message issued by H&R Block in primary section

- You may also check spam

- Click on the email

- Then scroll down and click on the link on the email

- Enter a new password and confirm it by clicking the reset button

That’s the end of it. You can log in with your new password using your username, phone, or email.

H&R Block Services Available On The Official Website

There are several product bundles to pick from, ranging from free to premium. After registering or entering into your H and R Block account, you can begin using any of these packages for free. The following features are shared by all H and R Block online products:

- 100% money-back guarantee

- Federal government free electronic shipping

- Free and limitless tax counseling

- Data security

- 100 percent accuracy guarantee

Before purchasing any of the packages, you can compare the Free, Basic, Deluxe, and Premium packages to see which ones include or do not include the following:

- An added benefit on your federal tax refund

- Free personal audit support

- Automatic import of your W-2 and 1095-A

- Easy-to-follow instructions

- Free import of prior year’s TurboTax® or TaxAct® refund

- Free limitless guidance from a tax expert

- Free technical support by live chat or phone

- Save your tax return and have access to it for the next six years.

- Automatic import of your 1099 and prior-year tax return from H&R block

- Guidelines for deducting property taxes and mortgage interest

- Maximize Tax Savings Through Charitable Donations

- Guidelines for Rental Income and Expenses (Appendix E)

- Maximize Deductions for Self-Employed Income (Chart C)

What Can You Do in My Account?

- Easy import of your tax records

- Real-time refund results

- Free Federal e-file

- Data security

- Earned income tax credit

Who should make use of H&R Block?

If you’re doing your own taxes this year and, like me, are willing to pay for convenience, H&R Block has a solution for you. Anyone who has never filed taxes on their own before or who has recently encountered substantial life changes might benefit from the advice provided by H&R Block.

For example, my financial situation last year was straightforward: I had W-2 income, a health savings account, and interest income from a high-yield savings account. I don’t own a home, don’t have any dependents, and I don’t invest outside of my retirement funds. I prepare and file both my federal and state returns using the Deluxe Online package (more on the specs of this option below).

The tax form import and upload capabilities save a lot of time, but if you don’t mind entering the figures yourself and want to save money, there are cheaper (or free) methods available.

- Log in to HRblock.com when you arrive at the H and R Block login screen.

- In the first field, please enter your username or email address precisely and carefully.

- Below the second box, you can see: “Forgot your password?”

- To reset your password, simply click on it.

- A new page will open; enter your new password and submit.

- •You will receive a confirmation email from H and R Block. Enter the code and you’re done.

- Respond to a few security questions to help identify yourself.

- Congratulations! You have successfully regained your H&R Block login password.

Information On The Various Portal Features/Benefits

We can’t possibly discuss all of H and R Block’s capabilities and benefits. With that in mind, here are the top perks you can expect as an H&R Block customer:

There are several plans to choose from: H and R Block provides a number of tax preparation programs, including online and in-person tax preparation and assistance. Their online plans are available in bundles that are suitable for regular paid W2 employees, freelancers, and small business owners, among others. You can even utilize the program for free to file basic federal returns.

Online plans can be purchased with a support add-on that includes “Assistance when requested by a registered tax professional, agent, or agent.” CPA. Although some services are more expensive, they provide personal assistance to people in need.

Audit Assistance: If you use H&R Block software to file your taxes and are selected for an exam, H&R Block will provide exam assistance. Block Basic, Deluxe, Premium, and Premium & Business desktop applications all come with free personal audit assistance.

Semi-Annual Tax Audit: All H&R Block plans now include a semi-annual tax audit, which can assist you in identifying improvements you can make to decrease your tax burden for the remainder of the year.

Accuracy Guarantee: This software is also guaranteed to be 100 percent accurate. “If the H and R Block tax preparation software makes a mistake on your tax return, we will refund the resulting penalties and interest up to a maximum of US $ 10,000,” according to H&R Block’s website.

100% money-back guarantee: You also get the most money back guarantee possible. H and R Block will even refund the expenses you spent for utilizing the program and allow you to change your return at no additional cost to secure a higher refund.

To Delete The Account, Follow These Steps

There are now two ways to delete your account from the H and R Block website, which are described below: –

Account On Call Delete

Call 1-800-HRBLOCK for more information (1-800-472-5625).

Once you’ve decided, ask the customer support agent to delete your account and follow the instructions.

Fill Out This Form To Delete Your Account

- Include a link to www.hrblock.com.

- For example, go down to the COMMENTS section of your PRIVACY POLICY and fill in the form’s details. Name and email address are required.

- Choose H and R Block Online from the product list.

- Select EXCLUSION POLICY under Select a topic.

- Fill in the comment section with your genuine reasons for cancelling your account before clicking the SUBMIT button.

Having trouble logging in? Tips to Follow

While it is uncommon for customers to need to use a troubleshooting guide, it is sometimes necessary.

To address the H and R Block Sign in problem, we’ll look at the troubleshooting guide here.

- Ensure that you have an active and dependable internet connection. This can result in unexpected issues like timeouts.

- Check that your information is entered accurately. Use the option to display your password if it is available. As long as no one has access to your password.

- Make sure Caps Lock is turned off.

- If you are still unable to access the website, delete your cache and cookies. Our instructions for the most popular browsers may be found here.

- Disable any Virtual Private Networks (VPNs) that you are utilizing. Certain national or local IP addresses are blocked by some websites.

- You may have forgotten your password if you are not using a VPN and have a good connection. Follow the steps below to obtain your password.

- If you continue to have issues and are unable to access your account, please contact us and we will gladly assist you as soon as possible.

How Much Does H&R Block Cost?

H&R Block charges less than TurboTax but more than TaxSlayer, TaxAct, or Credit Karma.

H&R Block has four major options for tax preparation and filing: do-it-yourself online packages, the ability to add Online Assist (i.e. extra support from an expert), full service from a tax preparer, and downloaded computer software.

Each of these categories has a different price point that is decided by the tax forms you require. Except for the computer program, you can prepare your return for free and just pay when it’s time to file.

Discounts are not included in the prices.

Cost of DIY choices and what they cover…

- Online for free: $0.W-2 income, unemployment income, interest and dividend income, retirement distributions, student loan interest deduction, tuition and fees deduction, child tax credit, and earned income tax credit are all supported (EITC). You can’t itemize deductions, which is standard for a free version.

Notably, the free edition of H&R Block allows student deductions, whereas TurboTax does not.

- Online Deluxe: $49.99 Everything in the free version, plus the mortgage interest deduction and health savings accounts, plus the ability to itemize.

- Online Premium: $69.99 Everything in the Deluxe version is supported, as well as rental property income and freelance/contractor income under $5,000. You may also input spending and miles from popular monitoring applications.

- Online Self-Employed: $109.99 H&R Block’s most expensive online tax preparation service. It’s great for self-employed people earning more than $5,000, such as small business owners, partners, and contractors.

Extra fees will apply if …

You must file with the state. If you live in one of the majority of states that also require you to pay state income taxes, you’ll have to pay an additional $36.99 per state.

- You may have to pay for numerous state returns if you resided or worked in more than one state.

- You purchase Online Assist. Almost identical to the online filing alternatives discussed above, however you can interact with a tax expert instantaneously and share your screen. A federal return costs between $69.99 and $194.99 in total.

- You upgrade to full-service preparation: Hand over your tax records to a professional, either in person or online, who will prepare and file your return. For a federal return, these services begin at $69.99.

H&R Block is paid from your refund. If you receive a tax refund, H&R Block will ask if you want to use a portion of it to pay for tax preparation services.

It appears to be more handy than pulling out a debit or credit card on the spot, but there is a $39 processing fee.

DIY tax options for expats

H&R Block released a package tailored exclusively for US people living overseas during tax season.

A federal return for simple job income costs $99, while one for investment and self-employment income costs $149. State returns cost an extra $99 apiece. Non-US bank and financial account reporting costs an additional $49.

There is also the option of filing with a tax advisor, which begins at $199 per federal return.

Contact Information

Contact by phone

1-800-472-5625

Monday to Sunday: 8:00 am – 8:00 pm.

H&R Block’s corporate headquarters are located at 1301 Main St, Kansas City, MO 64105.

For general inquiries, please call the H&R Block headquarters at (816) 854-3000.

Please visit the H&R Block website at www.hrblock.com for more information.

What Is The H&R Block Emerald Card?

H and R Block offers its own prepaid debit card, the Emerald Card, similar to the Jackson Hewitt TurboTax debit card or the American Express Serve card.

Customers can acquire their tax refunds more affordably using the Emerald Prepaid MasterCard.

Pay Bills Using H&R Block Emerald Card

Emerald H and R Block Card clients can make payments by visiting the official website HRblock.com and going to the Pay Bills area.

In the event of a problem or need for assistance, H and R Block Emerald Card Support can be reached at (888) -687-4722 or at the contact information provided below.

Access Your Emerald Card

To access your H&R Block Emerald card, go to the billing page, input your username/password on the right side of the page, and then click Connect. If you have forgotten your password or username, you can reset it by clicking the Forgot your password button. You may view your unpaid bills and make payments through internet banking in the My Accounts section. Visit the promotions page to redeem your reward points.

3 H&R Block Tools You Should Be Aware Of

- Second Look: With Second Look, H and R Block will examine your three previous tax returns to see whether you have lost any savings. According to the tax preparer, taxpayers frequently overlook tax deductions and credits (such as the EITC) and exploit the return status to make false statements, resulting in smaller refunds.

- H&R Block Tax Rate: If you enjoy filing taxes, as some do, the H&R Block tax rate may be for you. The 12-week course includes 60 courses that address fundamental issues like tuition, office, tax credits, and popular deductions and salary. Classes are free, however course materials must be purchased (usually $ 149).

- Redemption options: With H&R Block, you can use your tax refund to purchase an Amazon gift card in exchange for cash.

Last year, the average tax refund was more than $2,500, but what if you could go a step further? If you are eligible for a federal refund, H and R Block will add 3.5 percent to the value of your refund when put onto an Amazon.com gift card (up to $ 5,000). So, if you expect a $ 2,000 refund, for example, you get an extra $ 70 in your pocket. You must submit an electronic return for a qualified H & R Block tax package to take advantage of this offer.

H&R Block Customer Service

If you need help accessing your H&R Block online account, you can reset your password using the steps outlined above. This should be done if you believe your password or userID is incorrect or has been forgotten. You can also contact the customer service department.

H&R Block Customer Service Number: 1-800-472-5625 TTY: 855-508-0833

FAQs

Is H&R Block secure and dependable?

H&R Block uses data encryption to keep your information safe. To validate your identity, it also requires multi-factor authentication every time you log in.

If you follow the instructions and correctly enter the figures on your income forms, you should wind up with accurate taxes, just like if you went to a more expensive professional tax preparation.

However, according to a 2019 ProPublica investigation, H&R Block (together with TurboTax) utilized intentionally misleading techniques in the past to convince naïve taxpayers to pay for upgrades when they didn’t need to. As of this writing, H&R Block’s free file alternatives are prominently displayed, but it’s a good reminder to keep watchful.

Is there a disadvantage to employing H&R Block?

In my experience, the UI and customer service features work well, but if you’re searching for a low-cost option to file taxes, H&R Block isn’t it.

Unless you qualify for the free package, you’ll pay at least $49.99 (before discounts) plus an extra $36.99 each state return.

How do I make changes to my hr block?

- When you check for updates, the H&R Block Tax Software Manager dialog box will appear.

- Click Next in this dialog window.

- Click Update if an update is available.

- To download and install the update, follow the on-screen instructions.

Is it possible to get a holiday loan through HR Block?

If accepted, the funds are transferred to an H&R Block Emerald Prepaid MasterCard. Beginning November 18th, the refund advance loan will be accessible. The no-interest loan, which is only available for a limited period, will provide taxpayers with an early cash advance on their tax refund.

Conclusion

The H and R Block Portal H and R Block is a reliable and comprehensive tax preparation website. Whether you’re an H&R Block regular or new to the market, you’ll discover that this service combines outstanding tools and preparation tips to help you get the most out of it.

We hope that we were able to provide you with useful information on H&R Block Login.

Do you have any questions or suggestions? That is why we have a review feature on this website! You can write a review or two in the comments section below, and we’ll get back to you as soon as possible!